Tips To Help Protect Your Data

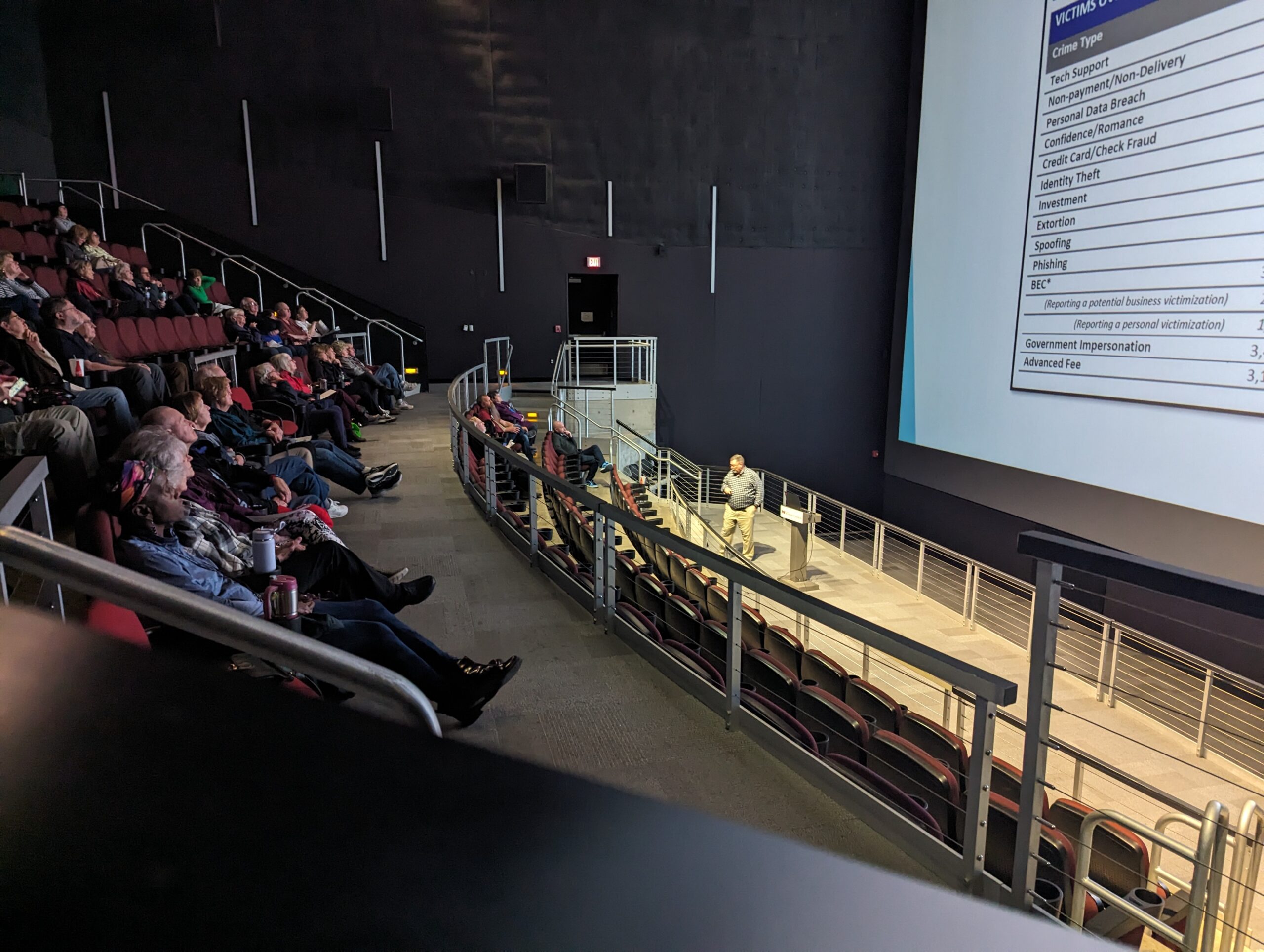

Given the recent

AT&T data breach, Anthony Mini recommends the following:

- Monitor your accounts with identity protection services.

- Check the status of your e-mail accounts that have been exposed to other breaches using the website: https://haveibeenpwned.com/.

- Never re-use a password from one account to another.

- Create strong passwords using the passphrase approach by mixing multiple words together, then adding a number and special character.

- Use a password manager if you don’t want to think about passwords anymore.

- Use Multifactor Authentication on all important accounts.

- Take advantage of credit freezes and year-long fraud alerts. Thanks to a federal law, these services are available for free. Here’s what you should know: https://consumer.ftc.gov/consumer-alerts/2018/09/free-credit-freezes-are-here.

Take steps to protect your data before a breach occurs, but it’s even more important after your personal information has been exposed. Though cyberattacks have been happening more frequently, we need to pay attention every time.

Free credit freezes

Security freezes, also known as credit freezes, restrict access to your credit file, making it harder for identity thieves to open new accounts in your name. Starting September 21, 2018, you can freeze and unfreeze your credit file for free. You also can get a free freeze for your children who are under 16. And if you are someone’s guardian, conservator or have a valid power of attorney, you can get a free freeze for that person, too.

How will these freezes work? Contact all three of the nationwide credit reporting agencies –

Equifax,

Experian, and

TransUnion. If you request a freeze online or by phone, the agency must place the freeze within one business day. If you request a lift of the freeze, the agency must lift it within one hour. If you make your request by mail, the agency must place or lift the freeze within three business days after it gets your request. You also can lift the freeze temporarily without a fee.

Don’t confuse freezes with locks. They work in a similar way, but locks may have monthly fees. If you want a free freeze guaranteed by federal law, then opt for a freeze, not a lock.

Year-long fraud alerts

A fraud alert tells businesses that check your credit that they should check with you before opening a new account. Starting September 21, 2018, when you place a fraud alert, it will last one year, instead of 90 days. Fraud alerts will still be free and identity theft victims can still get an extended fraud alert for seven years.

Credit freezes and the military

If you’re in the military, you’ll still have access to active duty alerts, which let you place a fraud alert for one year, renewable for the time you’re deployed. The active duty alert also gives you an added benefit: the credit reporting agencies will take your name off their marketing lists for prescreened credit card offers for two years (unless you ask them to add you back on).

You can place a fraud alert or active duty alert by visiting any one of the three nationwide credit reporting agencies –

Equifax,

Experian or

TransUnion. The one that you contact must notify the other two. You also can find links to their websites at

IdentityTheft.gov.

Issues with a credit freeze

If you think a credit reporting agency is not placing a credit freeze or fraud alert properly, you can submit a

complaint online or by calling 855-411-2372. If you think someone stole your identity, visit the FTC’s website,

IdentityTheft.gov, to get a personalized recovery plan that walks you through the steps to take.

For more information, check out

Place a Fraud Alert,

Extended Fraud Alerts and Credit Freezes, and

Credit Freeze FAQs. And if you’re considering a child credit freeze, you also may want to read

Child Identity Theft.

Does your business need help with

IT solutions,

cybersecurity,

data centers, or

audiovisual integration? Contact us to see what technology solutions might work best for you.